Strategic Geographic Position

Serbia is situated in the Balkan peninsula and represents a true connection between East and West Europe, South and North Europe. It is positioned at the border of the EU and the intersection of the Pan-European corridors 10 and 7 and has a strategic positioning for the European, Asian and Middle East markets. Furthermore, owing to its position on the geographic borderline between the East and West, Serbia is often referred to as a gateway of Europe.

Liberalized trade

Serbia has concluded trade agreements with its major trading partners, including the Russian Federation, Belarus, Kazakhstan, Turkey, as well as with EFTA (European Free Trade Association), CEFTA (Central European Trade Agreement) and European Union (The Interim Trade Agreement).

The free trade agreements that Serbia has signed make it possible for goods of Serbian origin to access markets of over 800 million consumers.

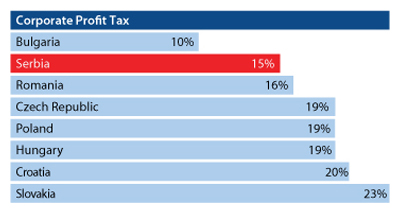

Attractive Tax incentives

The Serbian tax regime is hugely competitive and attractive: corporate profit tax is the second lowest in Europe (set at 15%), while VAT, salary tax, and social insurance contributions are among the most competitive ones in Central and Eastern Europe. The tax rates prescribed by the VAT Law are as follows:

- the standard VAT rate (20% applicable for most taxable supplies);

- the lower VAT rate (8% applicable for basic food goods, daily newspapers, communal services, etc.).

Corporate Income Tax Holiday. Companies are exempt from corporate income tax for a period of 10 years starting from the first year in which they report taxable profit if:

- they invest in fixed assets an amount exceeding +/- 8-9 million Euro (1 billion Dinars)

- they hire at least 100 additional full-time employees during the investment period.

Financial Incentives for Investment projects

Serbia offers a variety of attractive investment inventives for investment projects in production, export-related services, and strategic projects in tourism. State grants are offered for Greenfield and Brownfield projects in all industries, except for retail, hospitality, agriculture, production of synthetic fibers and coal. Also, there are The National Employment Service grants, which include the Employment Subsidies Program, the Apprentice Program and the Re-Training Program.

Free Zones

Free zones offer many advantages to companies and contribute to savings through different benefits. Namely, import into and export from these zones is free of VAT, customs and clearance, while income generated from production within a zone is exempt from taxation. For more information, please see the “Free Zones Administration of the Ministry of Finance of the Republic of Serbia” at www.usz.gov.rs or download the presentation “Free Zones of Serbia”.

Skilled and Competitive Human capital

With a unique combination of high-quality and low-cost skill-sets, the Serbian workforce is widely regarded as a strong business performance driver. In addition, Serbia boasts the highest English speaking proficiency in Eastern Europe.

Fast Track Company Registration

The business registration procedure in Serbia typically takes 5 days, down from the previous 23. This process at the Business Registers Agency can be completed in just 3 days, with a few additional days for other procedures. Visit the Business Registers Agency website here and start the process today.